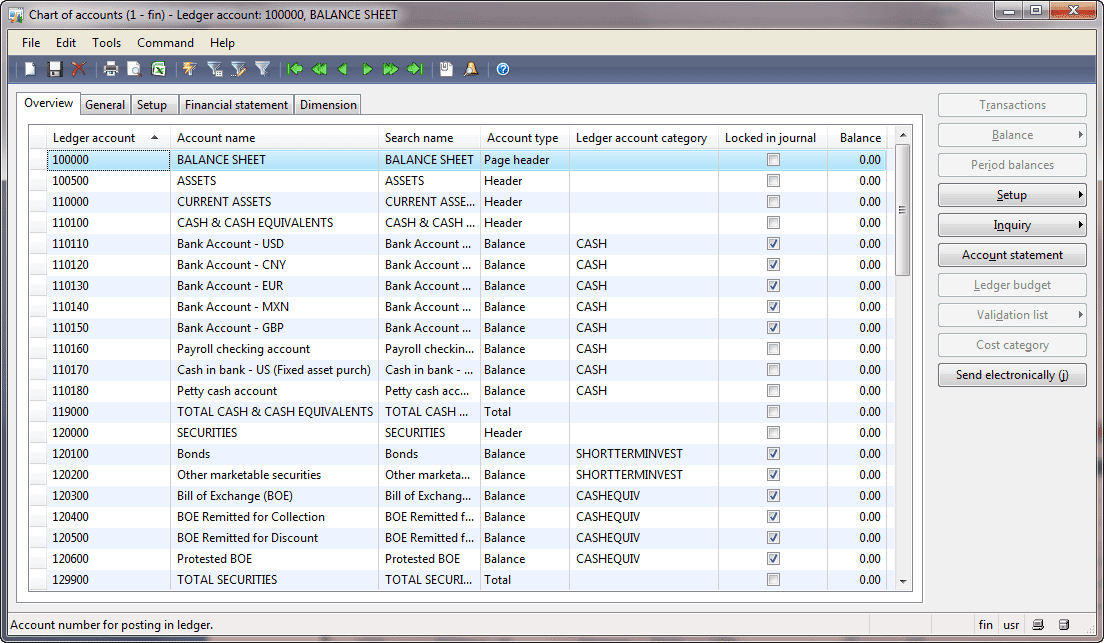

Nomenclature, classification and codification Įach account in the chart of accounts is typically assigned a name. However, in most countries it is entirely up to each accountant to design the chart of accounts. In some countries, charts of accounts are defined by the accountant from a standard general layouts or as regulated by law. The charts of accounts can be picked from a standard chart of accounts, like the BAS in Sweden. The accounts are typically arranged in the order of the customary appearance of accounts in the financial statements: balance sheet accounts followed by profit and loss accounts. Each nominal ledger account is unique, which allows its ledger to be located. The structure and headings of accounts should assist in consistent posting of transactions. However, in many computerized environments, like the SIE format, only numerical identifiers are allowed. Account numbers can use numerical, alphabetic, or alpha-numeric characters. In computerized accounting systems with computable quantity accounting, the accounts can have a quantity measure definition. Accounts may be added to the chart of accounts as needed they would not generally be removed, especially if any transaction had been posted to the account or if there is a non-zero balance.Īccounts are usually grouped into categories, such as assets, liabilities, equity, revenue and expenses.Īccounts may be associated with an identifier (account number) and a caption or header and are coded by account type. We are Sage 50 Experts and also offer installation, training, and support services on all Sage 50 Products, contact us today to discuss your Sage Requirements.A chart of accounts ( COA) is a list of financial accounts set up, usually by an accountant, for an organization, and available for use by the bookkeeper for recording transactions in the organization's general ledger.

New and improved user interface makes it much faster to navigate the system.Automatic Backup and Data Checking with the Schedule Backup Feature (Users no longer need to log out of the system to run a backup.E-mail Invoices and Statements to your customers.Quick Search Facility - improved in v29.Customer and Supplier Diary Integration.VAT Module with Online MTD (Making Tax Digital) Submissions.

Standard accounts software#

Sage 50 Accounts is reliable and powerful desktop software with the choice to also link your data to the cloud giving you greater flexibility and security.ĭesktop: Everyday accounts tasks such as managing cash flow, invoicing and VAT returns in up to half the time due to new intuitive and easier to navigate user interface. Sage 50 Accounts Standard subscription includes all software version upgrades ensuring that you are always on the very latest version of Sage 50 Accounts and are benefitting from the latest features and improvements.

0 kommentar(er)

0 kommentar(er)